As a developer running a B2B operation (sole proprietorship) in Poland, understanding the nuances of local taxation and available reliefs is crucial for financial optimization.

Here’s a comprehensive overview of key topics we’ve explored, from ZUS holidays to property tax implications and choosing the right PIT (Personal Income Tax) regime.

Important before we start: Consult a Professional, this is just my personal experience!

While this overview provides a good starting point, Polish tax law is complex and constantly evolving.

For personalized advice tailored to your specific income, expenses, and business activities, always consult with a qualified tax advisor or accountant.

They can help you navigate these regulations, ensure compliance, and optimize your financial situation. Remember, the form of taxation can generally only be changed once a year for the following tax year.

Personal Income Tax (PIT) Forms for Developers in Poland

Choosing the right tax form is a significant decision that impacts your overall tax burden.

If you are new in Poland, you might be starting with the UoP umowa o pracę (employment contract), but you can change it to a sole proprietorship ( działalność gospodarcza indywidualna) once you have a business.

Let’s say that with UoP you are in ‘auto’ mode, where the tax system is doing everything for you, but with sole proprietorship you are in ‘manual’ mode, where you have to do everything yourself.

If you plan to have a business to scale your own ideas, you should consider the sole proprietorship ( działalność gospodarcza indywidualna) as it will give you more control over your taxes.

Anyways, let’s see the options in a way that I would have like to get presented to me when I had no idea:

In Poland, B2B sole proprietors typically have three main options:

-

Progressive Tax Scale (Zasady Ogólne): This is similar to the UoP, but you have to do everything yourself + accountant

- Rates: 0% (up to 30,000 PLN annual income), 12% (30,000 PLN to 120,000 PLN), 32% (above 120,000 PLN).

- Health Contribution (składka zdrowotna): 9% of income.

- Pros: Allows deduction of business expenses and personal tax reliefs (e.g., for children).

- Cons: Higher rates for higher earners.

-

Flat Tax (Podatek Liniowy):

- Rate: A flat 19% regardless of income.

- Health Contribution: 4.9% of income.

- Pros: Can be advantageous for high earners with significant deductible business expenses, as it avoids the 32% bracket.

- Cons: Generally, you cannot benefit from most personal tax reliefs.

-

Lump-Sum Tax on Registered Revenue (Ryczałt od przychodów ewidencjonowanych):

- Rates: Various rates depending on the service, but for many IT services, it’s 12% or potentially 8.5%.

- Health Contribution: Fixed monthly amounts based on annual revenue thresholds. For example, for 2025

- ~461.66 PLN for revenue up to 60,000 PLN

- ~769.43 PLN for 60,000-300,000 PLN

- ~1,384.97 PLN for over 300,000 PLN

- Pros: Often results in a lower overall tax burden for developers with low business expenses due to the lower percentage rates. Simpler bookkeeping as you don’t track expenses for tax purposes.

- Cons: You cannot deduct business expenses to reduce your taxable income.

Take in considerations that business dont have paid holidays, you dont work, you dont get paid. The regular contract abstracts that part for you already and you have paid holidays.

You can read the official docs at https://www.podatki.gov.pl/dzialalnosc-gospodarcza/forma-opodatkowania/

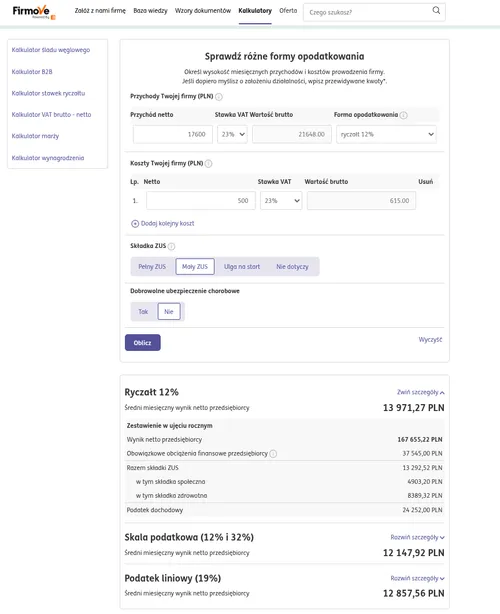

And look for gross to net calculators, like:

- https://firmove.pl/kalkulatory/kalkulator-stawek-ryczaltu

- https://zarobki.pracuj.pl/kalkulator-wynagrodzen

- https://wynagrodzenia.pl/kalkulator-wynagrodzen

In any of the selected B2B Tax approach: you will have to pay additional 408,6 PLN as składka społeczna

What it helped me to decide

I built couple of formulas with the information above, which my accountant passed to me.

So for the first option, the 12/32 I made: (Income-Expenses)* 0% or 12% or 32% plus (Income-Expenses from last month )*9% składka zdrowotna plus 408,6 PLN składka społeczna

8.5% vs. 12% for IT Professionals on Ryczałt: A Nuance

The specific lump-sum rate for IT services (8.5% or 12%) is a frequent point of discussion. It depends entirely on the precise nature of your services, as defined by PKWiU (Polish Classification of Goods and Services) codes.

If you are in IT, you might have a PKD of 62.01.Z - Computer programming activities

- 12% Rate: Generally applies to services directly “related to software” (e.g., programming, software design, development, consultancy, network management).

- 8.5% Rate: Applies to “other service activities not elsewhere classified,” which for IT could include more general IT support, project management, or UX/UI design, if not directly involving software creation or modification.

Determining your rate requires careful analysis of your B2B contract and activities, referencing the specific PKWiU codes and relevant tax interpretations. Consulting a specialized tax advisor is highly recommended for an accurate classification.

The “Wakacje ZUS” (ZUS Holiday) Program: A Welcome Break

Poland offers a beneficial program called “Wakacje ZUS” that allows eligible micro-entrepreneurs to temporarily pause their social security contributions for one chosen month per year.

- What it covers: Exemption from social security contributions (pension, disability, sickness, accident insurance).

- What it doesn’t cover: You must still pay your health insurance contribution (składka zdrowotna) during the ZUS holiday month.

- Savings: The amount saved depends on your current ZUS contribution level. For those on preferential ZUS contributions (like our example of 408.60 PLN), this is the amount you’ll save. The higher savings (e.g., 1700 PLN) apply to those paying full, standard ZUS.

- Eligibility & Limitations:

- Open to micro-entrepreneurs (sole proprietorships, up to 9 employees).

- Cannot be used if you’ve already used it in the current year or are already exempt from social contributions (e.g., via “Ulga na Start”).

- Crucial restriction: If you perform services for a former employer that are the same as those you did under an employment contract, you might be excluded.

- No reporting required: You are free to use the saved funds for business investments, personal needs, or savings – no need to inform ZUS of your use.

- Application: Submitting your application in month ‘X’ typically grants the holiday for month ‘X+1’, meaning you skip the ZUS payment due in month ‘X+2’. Your accountant can help prepare the application for a fee.

Working in UoP and B2B

If during the same FY you will be working first under UoP and later B2B, you should get ready to make PIT36 report during next year (before the end of April).

Be aware that the amounts that you earned via UoP, will be summed with the amounts that you earned via B2B.

So be prepared to pass the 120K limit, as you will have to compensate the 32% that you have not been paying month to month.

Using Your Property for Business: Mortgage Interest & Property Tax

If you plan to use a mortgaged property for your business activities:

- Mortgage Interest Deduction: You can deduct mortgage interest as a business expense. If the entire property is used for business, 100% of the interest is deductible. If only a portion is used, you’ll deduct a proportional percentage (e.g., 20% of interest if 20% of the property is for business).

- Property Tax Implications: Be aware that using part of your residential property for business may lead to a higher property tax rate on that portion. You should contact your local commune office (urząd gminy) to inquire about this change in designation.

Got it, here’s a markdown section specifically about the car part, with bullet points and bolding for clarity:

Tax Implications of Leasing a Passenger Car for Your Business

Leasing a car for your sole proprietorship in Poland involves specific rules for VAT and income tax deductions, especially for passenger cars used for mixed (business and private) purposes.

-

VAT Deduction (Input Tax):

- As an active VAT payer, you can generally deduct 50% of the VAT from invoices related to your leased passenger car.

- This applies to a wide range of costs, including leasing installments, the initial leasing fee, and fuel purchases.

- The remaining 50% of VAT, which you cannot deduct, effectively becomes part of your business cost for income tax purposes.

-

Income Tax Cost Deduction (Leasing Installments & Related Expenses):

- For cars with a gross value of 150,000 PLN or less:

- You can include 100% of the net amount of leasing installments and related costs (like fuel, repairs) in your tax-deductible expenses.

- Additionally, the 50% of VAT that was not deductible (as mentioned above) is also added to your tax-deductible costs.

- For cars with a gross value exceeding 150,000 PLN:

- The deductible amount for leasing installments and related costs (net value plus non-deductible VAT) is limited by a proportion.

- This proportion is calculated as 150,000 PLN divided by the car’s exact gross value. For example, if the car is worth 200,000 PLN gross, you can only deduct 75% of these costs (150,000/200,000 = 0.75).

- Your accountant will need the exact gross price to perform this calculation.

- For cars with a gross value of 150,000 PLN or less:

-

Insurance Costs (for Income Tax Purposes):

- OC (Mandatory Third-Party Liability Insurance): The full amount of OC insurance is 100% tax-deductible, regardless of the car’s value.

- AC (Voluntary Comprehensive/Collision Insurance):

- For cars with a gross value of 150,000 PLN or less: The full amount of AC insurance is 100% tax-deductible.

- For cars with a gross value exceeding 150,000 PLN: The deductible amount for AC insurance is also limited by the same proportion as the leasing installments (150,000 PLN / Gross value).

What to be aware

Former Employer B2B Rule: A Critical Tax Limitation

A crucial rule to remember: if your B2B contract is with a former employer with whom you previously had an employment contract, and you perform the same or similar activities, you may be precluded from choosing the Flat Tax (19%) or Lump-Sum Tax (Ryczałt).

In such cases, you would be required to settle your taxes under the Progressive Tax Scale (0%/12%/32%). This rule is designed to prevent simple reclassification of employment for tax benefits.